This bulletin aims to keep our members updated on the constantly evolving landscape of e-Invoicing complementing IATA's mission to serve the industry and support reducing costs for members. It will also give information on how SIS can help with your e-Invoicing compliance needs.

In this issue:

- SIS Compliance Updates

- e-Invoicing Global Updates

SIS Compliance Updates

Malaysia On 1 August 2024, The Inland Revenue Board of Malaysia (IRBM) launched mandatory e-invoicing with a phased approach.

- 1 August 2024 – Annual turnover or revenue more than RM 100m

- 1 January 2025 – Annual turnover or revenue between RM 25m to RM 100m

- 1 July 2025 – mandatory implementation for all other taxpayers

On 1 February 2025, the 6-month soft landing phase will end for the first wave of August 2024 large taxpayers.

To support participating airlines in CASS Malaysia for e-Invoicing, the SIS platform was enhanced to provide this as an optional service.

With Phase 2 quickly approaching, we will be hosting an information and training webinar to further explain how this integrated approach works.

Please join the below session to find out the details:

Webinar Sessions

• 11 December 2024 15:30-16:30 MYT

• 9 January 2025 16:00 – 17:00 MYT

You will receive the Team meeting invitation in a separated email.

Registration for the webinars:

Please click here to register, then, a separate invitation will be sent out via Microsoft Team with the dial in information the day before the webinar.

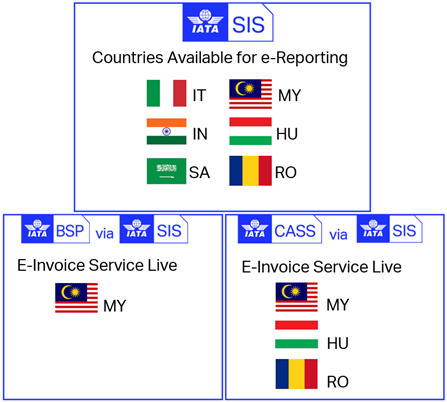

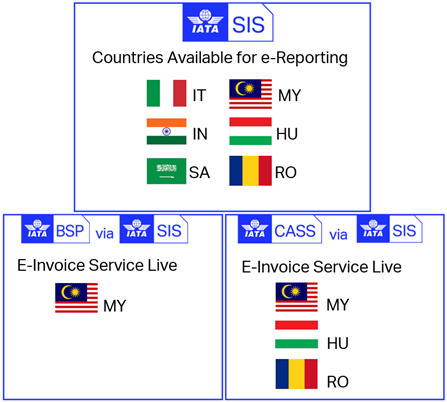

Countries with SIS Integration:

e-Invoicing Global Updates

- France [FR] - The French General Directorate of Public Finances (DGFIP) has released updated guidelines and a FAQ on the implementation of mandatory e-invoicing and e-reporting.

As of 1 September 2026, companies established in France and subject to VAT will have to accept electronic invoices. The mandatory issuance of electronic invoices will gradually take place between 2026 and 2027, while the obligation to receive electronic invoices will apply to all companies from 1 September 2026.

Electronic invoices will necessarily be transmitted via a partner dematerialization platform (PDP), which are government-certified e-invoicing service providers.

Discover the updated information from DGFIP for B2B e-invoicing and B2C e-reporting

- Germany [DE] - The Federal Ministry of Finance updated their FAQ on the introduction of mandatory e-invoicing on 1 January 2025.

Here is the link to the Frequently Asked Questions.

- Greece [GR] – AADE has made available a new version of myDATA technical specifications.

The Independent Authority for Public Revenue (AADE) has released v1.0.10 of myDATA technical specifications.

New version 1.0.10 includes:

- Transmission from ERP channel of fuel invoices FUEL format (fuelInvoice = true)

- Transmission by ERP channel and provider 9.3 Shipping Note with FUEL format

- New Method of retrieving information for E3 records, either by invoice or by day

- In the case of a transmission with transmissionFailure, a past date dispatchDate is also allowed.

Learn the full technical details about MyDATA v1.0.10

- Portugal [PT] - Postponement of Electronic Signature Requirement

With Portugal's State Budget 2025 approval, the mandatory Qualified Electronic Signature (QES) requirement is to be effective a year later than expected, in January 2026. Therefore businesses can continue using PDF invoices as 'e-invoices' until 31 December 2025.

The SAF-T has also delayed one year and the first report will be in 2027, although for resident businesses the initial reporting will be in 2026.

Access here the approval of Portugal’s State Budget for 2025

- Singapore [SG] - The Inland Revenue Authority of Singapore (IRAS) published the inputs received on the draft of the e-Tax Guide

IRAS has published the document Summary of Responses - Public Consultation on the Draft e-Tax Guide “Adopting InvoiceNow Requirement for GST-registered Businesses”.

This document summarizes responses to the feedback and comments received during the Public Consultation exercise between 12 June and 25 July 2024 about the draft e-Tax Guide “Adopting InvoiceNow Requirement for GST-registered Businesses”. The outcome of this consultation exercise will be the publication of a revised e-Tax Guide and a list of Frequently Asked Questions (“FAQ”) to include these inputs.

Read the details of the Summary of Responses Published

- Saudi Arabia [SA] - ZATCA Determines the Criteria for Selecting the Targeted Taxpayers in Wave 18

ZATCA determined the criteria for selecting the targeted taxpayers in the Wave 18 for implementing the Phase 2 (Integration Phase) of E-invoicing, which includes all taxpayers whose revenues subject to VAT exceeded SAR 2 Mn during 2022 or 2023.

ZATCA will notify all targeted taxpayers to integrate their E-invoicing solutions with ZATCA's platform (Fatoora) by no later than 31 August 2025.

Read the full article about Wave 18 for “Integration Phase” of E-invoicing