This bulletin aims to keep our members updated on the constantly evolving landscape of e-Invoicing complementing IATA's mission to serve the industry and support reducing costs for members. It will also give information on how SIS can help with your e-Invoicing compliance needs.

In this issue:

- e-Invoicing Global Updates

- SIS Updates

e-Invoicing Global Updates

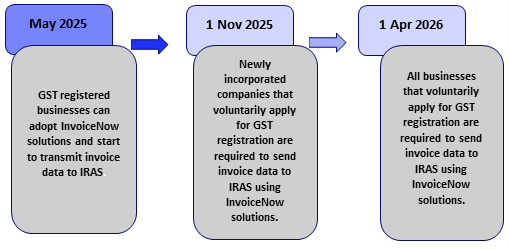

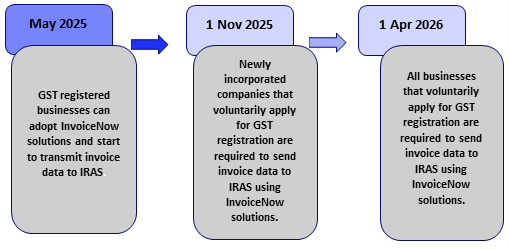

- SG (Singapore) The Revenue Authority has unveiled plans for the phased introduction of InvoiceNow e-invoice reporting in 2025 – 2026. The Inland Revenue Authority of Singapore (IRAS) announced a staggered rollout of e-invoice data reporting through the InvoiceNow network. The InvoiceNow network, which was built upon Peppol and introduced in 2019, facilitates the seamless transmission of invoices in a structured digital format. The timetable for launch for domestic businesses is as follows:

- PL (Poland) The Polish Ministry of Finance had postponed the mandatory KSeF deadline previously scheduled for 01st July 2024. The Ministry has launched a public consultation for the revised Polish e-Invoicing mandate. Although the anticipated announcement of the new KSeF launch date is not included in the new documentation, it is expected to be announced within the next few weeks. However, the new mandate will not take effect in 2024. Here is the official announcement of postponement.

- MY (Malaysia) is gearing up for mandatory e-Invoicing starting on August 1, 2024, with the Inland Revenue Board launching a new e-Invoice Software Development Kit (SDK). This SDK facilitates businesses in integrating their systems with the MyInvois System via API, requiring sales invcoies in XML format to be sent to tax authorities for verification. This is part of the country's move toward implementing Continuous Transaction Control (CTC) e-Invoicing. The tax authorities have announced a pilot phase will commence in May 2024, involving over 50 businesses. Here are some FAQs.

- AE (United Arab Emirates) The UAE is set to adopt a 5-corner model known as DCTCE, leveraging Peppol specifications for a seamless implementation. The project includes different phases and targets that are set to be completed by July 2025. For more information, please follow the provided link.

- RO (Romania), The Romanian government has announced a postponement until May 31st for the enforcement of fines related to non-compliance with the deadline for transmitting one or more invoices in the national electronic invoice system, RO e-Factura, during a calendar month. This extension aims to provide taxable persons with additional time to adjust their procedures and systems for transmitting invoices within the RO e-Factura system, thereby avoiding penalties. You can read more about this here.

- DE (Germany) The German Bundesrat (the upper house of Parliament) approves a mandate for B2B e-Invoicing on March 22, 2024, incorporating a provision for mandatory B2B e-Invoicing. This measure will be phased in, starting from January 1, 2025, when it will become compulsory for businesses to accept structured e-invoices.

- BE (Belgium) has officially declared an e-Invoicing mandate, which will take effect on January 1, 2026. As part of this initiative, they intend to utilize the PEPPOL network, a secure platform for exchanging structured electronic invoices among businesses. You can find more information here.

- FR (France) The French tax authority, Direction Générale des Finances Publiques (DGFiP), recently held a meeting to discuss the timeline for the upcoming e-invoicing mandate. Here are the key points and timeline and more information available on this link.

►Q2 2024: New technical specifications will be published. Service providers can obtain Partner Dematerialization Platform (PDP) status without proving connectivity with the Public Billing Portal (PPF).

►Q3 2024: First PDP certifications are expected to be issued.

►Q4 2024: A restricted pilot program will be conducted on a smaller scale, testing the PPF directly and core functionalities.

►2025: A larger-scale pilot program will involve numerous participants.

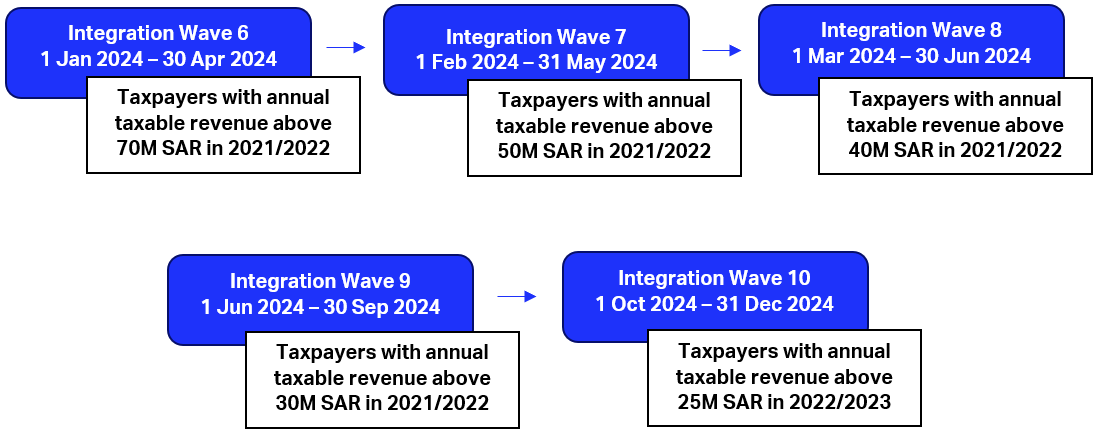

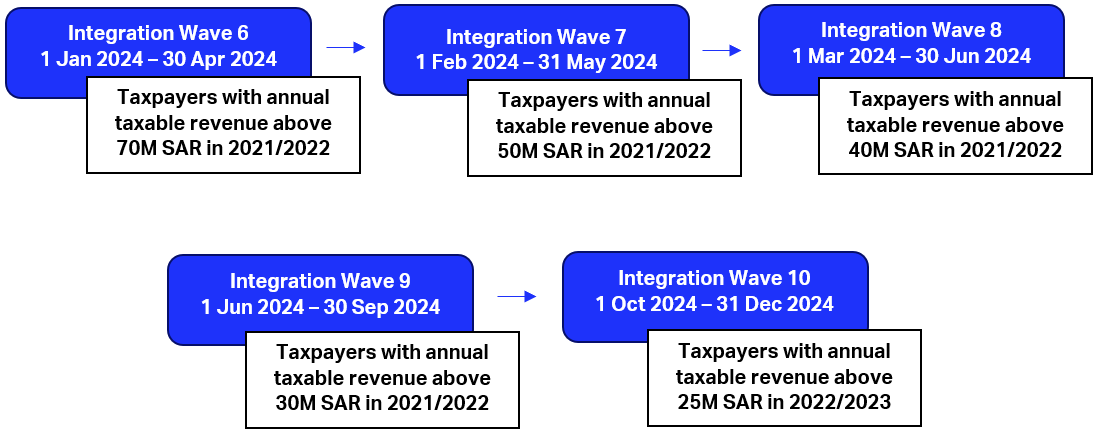

- SA (Saudi Arabia) The criteria for selecting targeted taxpayers' wave 10 of Phase 2 to implement the "Integration Phase" of e-invoicing is determined by the Zakat, Tax, and Customs Authority (ZATCA) through this announcement on March 29, 2024. Taxpayers whose revenue subject to VAT exceeded 25 million Saudi Riyals in either 2022 or 2023 will be included. These taxpayers are required to prepare for integration and compliance with the FATOORAH regime by October 1, 2024. The upcoming phases are below, and prior roll-out phases can be found here.

SIS Updates

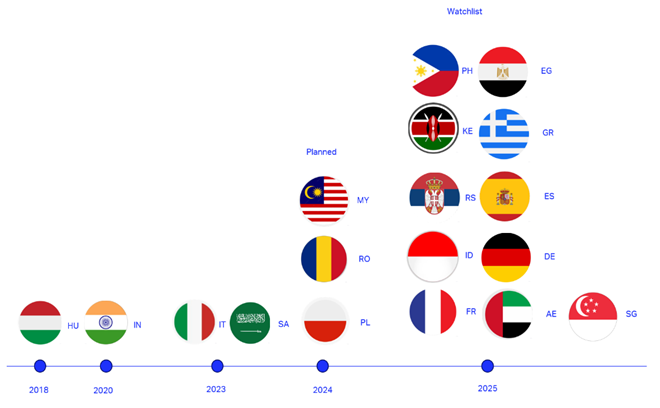

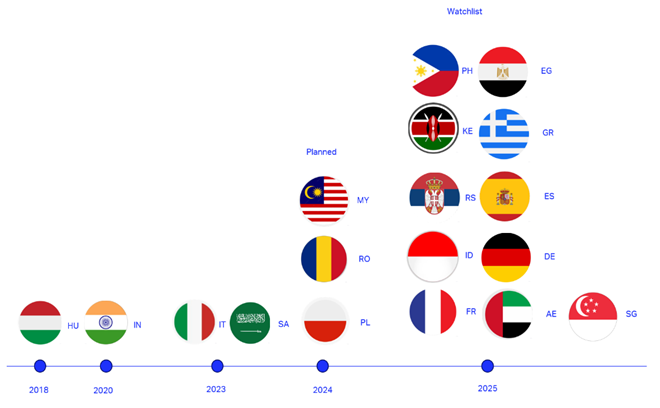

- HU (Hungary) -Real Time Invoice reporting and (IN) India - sending invoices to the Invoice Reporting Portal (IRP) were the first two countries to be connected to SIS in 2018 and 2020 respectively.

- SIS is now connected to the SA (Saudi Arabia) ZATCA system and IT (Italy) SDI system for B2B invoices. We are currently testing the integration of RO (Romania) and are exploring MY (Malaysia) Alongside this, we are closely monitoring other countries on our watchlist.

- This not only facilitates invoices generated by SIS users but will also be extended to invoices raised for IATA BSP and CASS transactions that could be submitted to the authority systems via SIS. To know more about this feature contact us.

Subscribe to SIS e-Invoicing Tax Compliance Bulletins by logging a request through the IATA Customer Portal.